- What do you do when your product launch fails (or doesn’t perform as expected)?

- How do you figure out where you “messed up”?

- Is it bad timing, is the price too high, is your product not compelling enough?

There’s only one way to find out – by talking to your customers.

And the first step in that process is usually sending a “non-buyer survey” to your leads that had the opportunity to buy the product but didn’t.

Since I’ve been asked over and over again by my clients to share an example of a non-buyer survey (as well as how to interpret the data), I decided to write a post it where I’ll show my whole process of performing non-buyer surveys with you.

Why do you even need a non-buyer survey?

Non-buyer surveys are great because they allow you to start identifying the exact reasons why your customers aren’t buying your products.

The insights from non-buyer surveys then help you improve the product pricing, positioning and sales copy to make sure your next product launch does way better than the next one.

But the one thing that people miss when it comes to non-buyer surveys is that the surveys aren’t the end of the story – they are just a means to an end.

Perhaps the most valuable role of non-buyer surveys is that they allow you to find interested potential customers that you can call on the phone to dig even deeper into the reasons why they didn’t buy your product.

If you’re not using a non-buyer survey, you’re missing out on all the valuable data on why your customers aren’t buying (and if you’re relying on your guesses and assumptions and not data… get ready for a world of pain and failed launches).

So if you don’t have a non-buyer survey yet, you definitely need one!

How I learned to write a non-buyer survey

I first learned how to write a non-buyer survey back in 2014 when I worked through Ramit Sethi’s Zero to Launch to set up my own online business.

When I had a product launch that did “okay”, I asked his product development team how to make the launch better.

They told me that non-buyer surveys aren’t a place where you need to reinvent the wheel, and that they’d send me some templates I could use right away.

They were right. The survey templates that they’ve sent me worked exceptionally well and I use them to this day, and I’ve seen Ramit Sethi use these exact surveys to get non-buyer feedback for his products as well.

I’ve also seen a lot of my friends use the same surveys in their own businesses with great results, which is why I decided to write about these surveys in this post.

So without further ado, here’s a template that you too can use to write your very own non-buyer survey.

Below the template, you’ll also find the step-by-step instructions for how to analyze the survey data, as well as how to email the survey out to your readers.

Although it is possible to use a top business phone system and have the survey done by phone. This can be quite costly if additional employees are needed to carry out the extra task. So in the spirit of saving of money I recommend using a software like Surveymonkey to host your survey as the basic plan is free and it gives you a great overview of the data.

Non-buyer survey template

Here are the survey questions that you need to ask in a non-buyer survey

1. I noticed you had the opportunity to join PRODUCT NAME but decided not to join at this time. Would you say you were at least considering joining of were you not interested at all?

(yes / no)

2. Which of the following factors played a role in your decision? (choose one of more)

– I don’t have time

– I can’t afford it

– I don’t understand what it is

– I’m not sure it can help me

– I’m just not interested

– Other (please specify)

3. In your own words, why didn’t you join? Please be as specific as possible.

(paragraph box)

4. If you were interested but didn’t join, what will you do about TOPIC instead? (Leave blank if TOPIC doesn’t interest you)

(paragraph box)

5. Name / Email

You can tweak these to fit your own product, brand and language, but I wouldn’t tweak them too much. The overall structure and length of these questions should be more or less the same (so don’t try to add 3 more super long questions to the survey – save the extra questions for the 1on1 calls).

How and when should you send a non-buyer survey to your non-buyers?

Your potential customers will likely be the most engaged in the week right after the product launch once the memory of it is still clear.

If you can, you should send out a non-buyer email to your readers within 2-3 days of finishing your launch (if you finish it on Friday night, you can send out the survey on Monday). But even if it’s been a few weeks since your launch, it’s never too late to send out the survey and still get some good responses.

In terms of what to send, you can keep things super simple.

You could send out an email like this (with a subject line “Can I get your feedback?”):

Hi NAME,

I noticed you had the opportunity to join PRODUCT NAME but decided not to join at this time. Would you mind telling me why? (I’m not trying to sell you anything. I just want to learn how I can better serve you.)

SURVEY LINK

Thank you!

You can tweak this email to fit your voice and brand, but I do recommend keeping it super short to get the maximal responses from it.

Analysis of non-buyer survey questions

Ok, now let’s look at each of these questions in detail to understand WHY we’re using each of the questions from the survey.

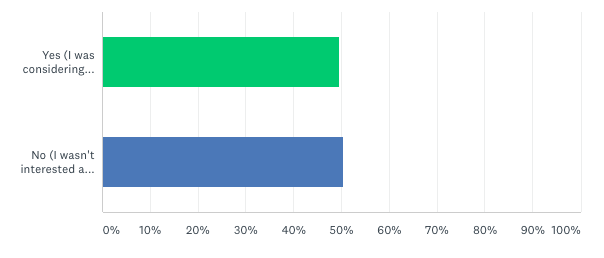

QUESTION #1: Were you interested in joining the program?

This question allows you to separate the people who were not interested in joining your program from the ones that were.

You can then further the not interested in joining the program into two groups:

- People who might never buy anything (or this program) from you

- People who might buy from you, but just weren’t convinced that they really needed your program.

Here’s an example:

- If you’re selling a program about fitness to an entrepreneur and they’re already invested in another sport (or know how to be fit already), they will likely never buy this program from you.

- If you’re selling a program about mindset to a painter and the painter says “I just don’t think that mindset is that important”, then you probably could reach them in the future if you tweaked your messaging successfully.

In the latter example, it’s not that they’ll never buy from you, it’s just that you haven’t showed them (or convinced them) WHY mindset is so important to them, so they never became interested in the product.

When you reach out to people in the second category, you should try to find out why they think that mindset isn’t important (and address those concerns with your next product launch).

Now we’ve covered the people who were not interested in joining your product.

With the people that WERE interested in joining your product, you have a group of people who wanted to buy from you but had concerns against buying (which you’ll be able to identify and improve through insights you get from other questions).

One last thing we should mention is that you should look at the ratio of how many people were interested in joining / weren’t interesting in joining, because that allows you to determine where you went wrong.

If the majority of people WERE interested in joining, it means that the product is desirable, but you didn’t address the buyer’s concerns well enough.

If the majority of people WERE NOT interesting in joining, it means that either the product wasn’t desirable, or you haven’t made it desirable enough (which you need to dig into with further research).

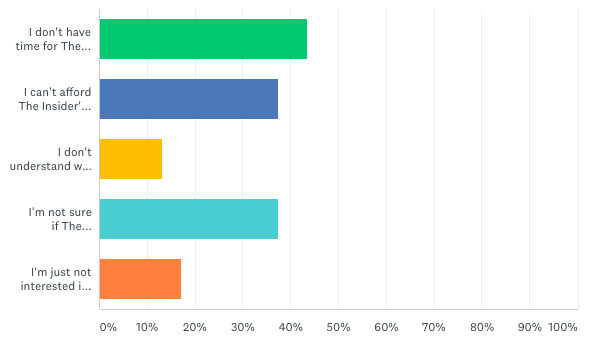

QUESTION #2: Why didn’t you join the program?

With this question, we’re trying to identify the main concerns our potential had around buying the program. Did our potential customers not buy because of limited time, money, or something else?

Once you collect the results from your survey, you’ll first want to look at the data in a quantitative way:

You’ll want to look at which of the reasons were the most popular, and which were less popular.

Here’s a simplified way to analyze this kind of data:

- IF a lot of people said that they lack time for the program, THEN your program either feels “too hard / time consuming”, OR you haven’t made it seem important enough for people to dedicate the time.

- IF a lot of people said that the program is too expensive, THEN your program is either priced too high OR the benefits of the program didn’t seem valuable enough to them.

- IF a lot of people said that they didn’t understand what the program is, THEN you didn’t make your offer (product outline / what it includes) clear enough through your emails and your sales page, OR you made it too confusing.

- IF a lot of people said that they’re not sure how the program can help them, THEN the benefits didn’t resonate well enough OR weren’t convincing enough.

- IF they just weren’t interested you can ignore the responses from this person (or address them as you analyze the responses from people who were not interested in joining).

As you analyze this data, you want to get a clearer idea what was the BIGGEST issue that you need to address and improve, and which are minor issues that you don’t need to worry about so much.

Is it the pricing? Is it the clear offer? Is it the benefits?

Then, you’ll want to primarily focus on the major issues as you dig into the data further. If we look at the graph above, I’d definitely dig deeper into the “no time”, “no money”, and “how can it help me?” issues, while I’d spend less time digging into “what is the program?”.

You’ll be able to do that by digging through the next few questions (and jumping on further non-buyer phone calls withy our potential customers).

QUESTION #3: In your own words, why didn’t you join?

This is the question where the real gold lies and where most of your attention will be spent as you analyze the data.

Here, you’ll start to see more specific reasons why people didn’t join, and you’ll likely start to see patterns between what people are saying.

- For example, if a lot of people say something along the lines of “I struggle with procrastination and there’s no way I could put in the hours to go through the course”, that means that your course doesn’t seem easy or achievable enough.

- If a lot of people say “I’m focused on other areas of my business development right now”, it means that you didn’t make the program seem important enough that people would want to take it (or you didn’t target a real, strong enough problem they have).

- If a lot of people say “I don’t understand what it is or how it would add value to me right now”, that means that you didn’t make the offer clear enough (you didn’t explain which problem you solve for your audience clearly enough).

This might seem similar to the analysis that you were doing in the previous step – and it is – but the distinction here is that you can dig deeper into the data by finding more SPECIFIC reasons why people aren’t joining.

The first thing you can do to do that is to group your data from each category in a document, and start analyzing the data within each of the reasons.

For example, within the “I’m not sure if this program is right for me”, you could see concerns like:

- “You seem to be targeting 20-25 year old, introverted people while I am 40+”

- “I need to find a profitable business idea first before joining this program”

- “I didn’t feel like paying money just to join a Facebook group”

Then, once you find enough real reasons why people aren’t joining your program, you can call them over the phone to get them to tell you more about them (and get even more clarity on what’s stopping them from joining)..

The main benefit of seeing these results is that you can start seeing REAL problems in the language of the people, that you can then work through step by step as you’re preparing your next launch.

Note that this isn’t an easy task, and that some of the data won’t be as clear / super useful. You’ll definitely get some responses like “I just didn’t have the time” or “I just wasn’t interested”, which won’t be useful.

But when you get a response like “I really don’t have the time right now”, but the response is 2 pages long, then that’s suspicious – how come they didn’t have the time when they have the time to write a really long response to you?

Or when they say “it was too expensive”, but then they mentioned they joined 5 other online programs (or are planning on joining them), then that’s again something very interesting that you want to look into more.

You can use these answers as a great starting point to identify potential improvements in your copy, as well as a great starting point for your 1on1 phone calls later on down the line.

QUESTION #4: What will you do instead to solve this problem?

With this question, you’ll be able to identify:

- Potential competitors that are solving the problems you’re promising to solve better than you are

- Additional concerns that prevent people from joining (like “I don’t think paying for connections is worth my time”)

- Less effective alternatives that you didn’t talk about (like “I’ll just read a few blog posts instead”).

You can expect to find less valuable data here (as some of it will be repetitive, though once in a while you’ll discover something you didn’t think of yet which will be worth the digging).

QUESTION #5: Your name and email

This is perhaps the most important question in the whole survey, as it allows you to schedule 1on1 calls with your customers to follow up on their responses and discover deeper insights that you won’t be able to find through a quick survey.

So don’t skip this question!

What’s next?

Once you do an initial analysis of the survey responses, reach out to at least 3-5 people whose answers you’ve found interesting to talk to them for 15 minutes on the phone and get information from them (the more the merrier).

You can use an email like this to do that (subject line: I’d love to talk to you about your survey response!):

Hi NAME,

Thank you so much for filling out the survey about PRODUCT NAME last week.

I’ve found your response really interesting, especially the part about ________

INSERT THEIR SURVEY RESPONSE

I’d love for you to tell me more about that as I really want to serve you as best as possible in the future.

Would you be willing to jump on a 15-minute Skype call with me to talk more about it?

If yes, let me know and I’ll send you some times when we can talk.

Thank you!

-YOUR NAME

Right now, you have a survey template ready to use, as well as the email you can send it out with, and a starting point to analyze the data, which is more than enough to get started.

You can start digging through the data and start scheduling the 1on1 calls with your potential customers instead.

I’ll write more about the non-buyer phone calls in the future (as they’re something you need to learn as well) and maybe do a real-life analysis of a non-buyer survey as well, so stay tuned.

-Primoz

Have questions about non-buyer surveys or how to analyze the data? Leave a comment below!

Learn how I attracted 337,838+ visitors to my blog

Download my free 13,000+ word Ultimate Guide Checklist and learn how I used Ultimate Guides to drive 337,838+ visitors to my blog!

This is gold. Thank you so much!

You’re welcome!

This is a very useful and straight to the point Non-Buyer Survey template.

I’d love to learn more about what you ask on the follow up calls to respondents.

Thanks Primoz!